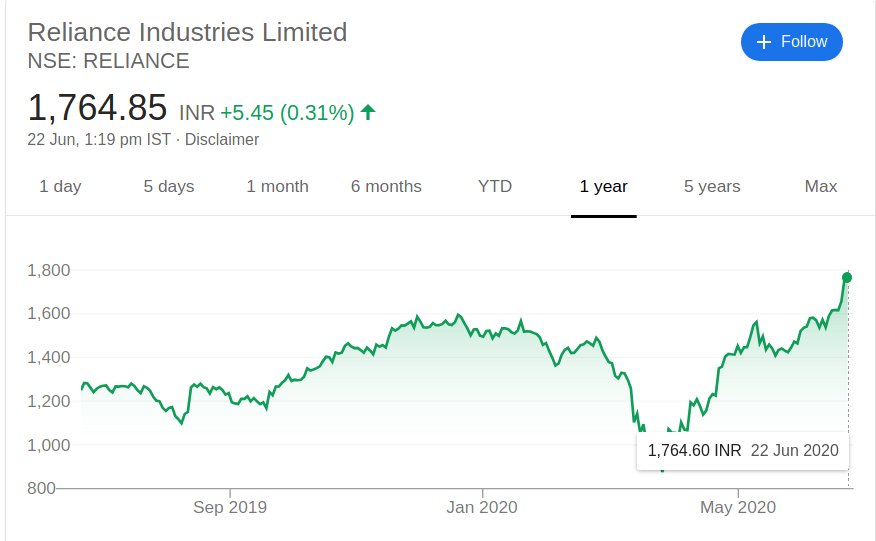

Reliance Share Price Today: Live Updates And Market Trends

Reliance Industries Limited is one of India's biggest and most powerful companies. It has long been a major player in the Indian stock market. Reliance’s stock is one of the most-watched in India. It has a diverse portfolio that includes petrochemicals, telecom, retail, and digital services.

Investors and market fans are watching the Reliance share price live today. They want to track market trends and predict future movements. But why is Reliance's stock so crucial, and what factors influence its price? Let’s explore this in more detail.

Reliance Share Price Today Live: Key Factors to Watch

Before we discuss the Reliance share price target for 2030 and live updates, let’s look at what affects Reliance’s share price both now and in the future.

1. Company Performance

Reliance’s business model is highly diversified. It works in many industries. This includes oil refining, petrochemicals, and telecommunications through Jio. It also operates in retail through Reliance Retail.

Read Also: Lenskart IPO GMP Today: Latest Grey Market Premium, Price, and Listing Updates

Positive performance in any of these sectors can directly impact the Reliance share price today live. Jio’s move into digital services and retail is boosting its finances.

2. Market Sentiment

The stock market is heavily influenced by investor sentiment. Reliance’s share price often reacts to news, economic indicators, and global trends. If oil prices go up, Reliance’s petrochemical business might benefit. This could lead to a rise in its share price.

3. Government Policies and Regulatory Changes

Government regulations, like those in telecom or oil, can affect Reliance’s operations. In India, Jio's pricing and spectrum choices can influence investor sentiment and impact share prices.

4. Global Economic Trends

Reliance's worldwide operations and presence expose it to global economic conditions. A positive global economic outlook can help boost share prices, while a downturn or economic crisis may hurt performance.

5. Technological Advancements

Reliance is making large investments in future technologies, including renewable energy, artificial intelligence, and 5G networks. Any breakthroughs in these areas could have long-term positive effects on the company’s stock price.

6. Earnings Reports

Quarterly earnings reports are one of the most important indicators for stock price movements. When Reliance posts strong profits, it can drive its stock price up. Conversely, disappointing results could cause the share price to dip.

Reliance Share Price Target 2030: Long-Term Prospects

It's hard to say exactly what Reliance stock will cost later, but many analysts think the share price target for 2030 looks good. Many experts see a bright future for the company. Current market trends and its bold growth plans support this optimism.

1. Expansion in Retail and Telecom

Reliance Jio has changed the Indian telecom industry. Its growth into areas like 5G services should boost the company's value. Reliance Retail is also expanding quickly.

It's taking advantage of the growing consumer market in India. These sectors are likely to continue performing well and contribute to the long-term growth of the company.

2. Investments in Renewable Energy

Reliance is investing heavily in green energy, with a focus on solar energy, hydrogen, and electric vehicle infrastructure. As the world moves toward sustainable solutions, Reliance's investments in these areas could yield strong returns. This may boost the company’s stock value in the years ahead.

3. Digital and Technological Innovations

Reliance is also making strides in technology, particularly in the digital space. From e-commerce platforms to artificial intelligence, the company’s future in tech appears bright. As Reliance embraces new technology, it could boost shareholder value. This may lead to a rise in its long-term stock price.

Many experts predict that Reliance's share price target for 2030 may exceed market expectations. Yet, like any investment, there are risks involved, and market conditions could always change.

How to Track Reliance Share Price Today Live?

If you’re looking to track the Reliance share price today live, there are several easy ways to do so.

You Must Also Like: Ola Electric Mobility Share Price Target 2025: What You Want to Know?

1. Stock Market Websites

Websites like Moneycontrol, Bloomberg, and NSE India provide real-time updates on share prices. These platforms offer charts, news, and analysis that can help you track the movements of Reliance stock as they happen.

2. Mobile Apps

For on-the-go updates, you can download stock-tracking apps like Zerodha, Groww, or Upstox. These apps give you live stock price updates and alerts based on what you like. This way, you won't miss any big changes in Reliance's stock.

3. News Channels

Channels like CNBC, ET Now, and Bloomberg Quint often report on market shifts. They provide updates on Reliance Industries, too. Following these channels can help you stay informed about any major changes in the stock’s performance.

4. Brokerage Platforms

Many brokerage platforms offer real-time data on stock prices, along with analysis and predictions. If you invest frequently, these platforms are great for tracking Reliance's live share price. They help you make informed decisions.

Short-Term Movements in Reliance Stock

In the short term, Reliance share price today live can fluctuate due to various factors such as:

- Quarterly earnings reports

- Economic news

- Changes in government regulations

Global events like oil price changes or tech advancements

These fluctuations are part of the nature of stock markets. Reliance’s varied portfolio and strong market position often make it more resilient than many other companies. That's why short-term drops in its stock price are usually followed by quick recoveries. This makes the stock a safer choice for long-term investors.

Factors that May Drive Future Growth

Reliance has big plans for the future, and these plans could have a major impact on its share price over the next decade. Let’s look at some key growth drivers that may impact the Reliance share price target 2030.

1. Jio’s Continued Expansion

Reliance Jio is one of India’s most successful business ventures in recent years. It has disrupted the telecom industry with affordable data plans and a large user base.

Jio plans to launch 5G and explore new areas like broadband and smart home services. This move may boost growth for its telecom division for years ahead.

2. Retail Growth

Reliance Retail is expanding rapidly across India. It’s focusing on both physical stores and e-commerce, making it a leader in the Indian retail sector. As India's middle class expands, demand for retail goods will rise. Analysts expect this trend to increase Reliance’s share price over time.

3. Energy Transition

Reliance’s investments in renewable energy—like solar, hydrogen, and electric vehicles—set it up for future growth. Reliance's green energy projects may boost profits as the world shifts to cleaner energy. This could raise its stock price.

4. Global Expansion

Reliance has global ambitions, including expanding its presence in international markets. If the company enters new markets like Asia and the Middle East, it could boost its finances and raise the share price.

Conclusion

Many factors affect the live price of Reliance shares and their long-term growth. The company is moving into telecom, retail, petrochemicals, and green energy. This expansion boosts its chances for growth in the future.

For long-term investors, the Reliance share price target for 2030 looks bright. There are chances in new technologies and global growth. You can track Reliance's share price live today with little effort. Many platforms provide real-time data. If you want to invest in Reliance, watch for important updates.

Focus on Jio’s growth, retail expansion, and green energy projects. These factors will likely impact the stock's performance over time. Investing now might help you enjoy future rewards. Stay informed. Always talk to financial experts. They can help you make smart investment choices that fit your financial goals.